How ESG is Reshaping Business Strategies in Emerging Markets

By Humberto Melo, Northeastern University

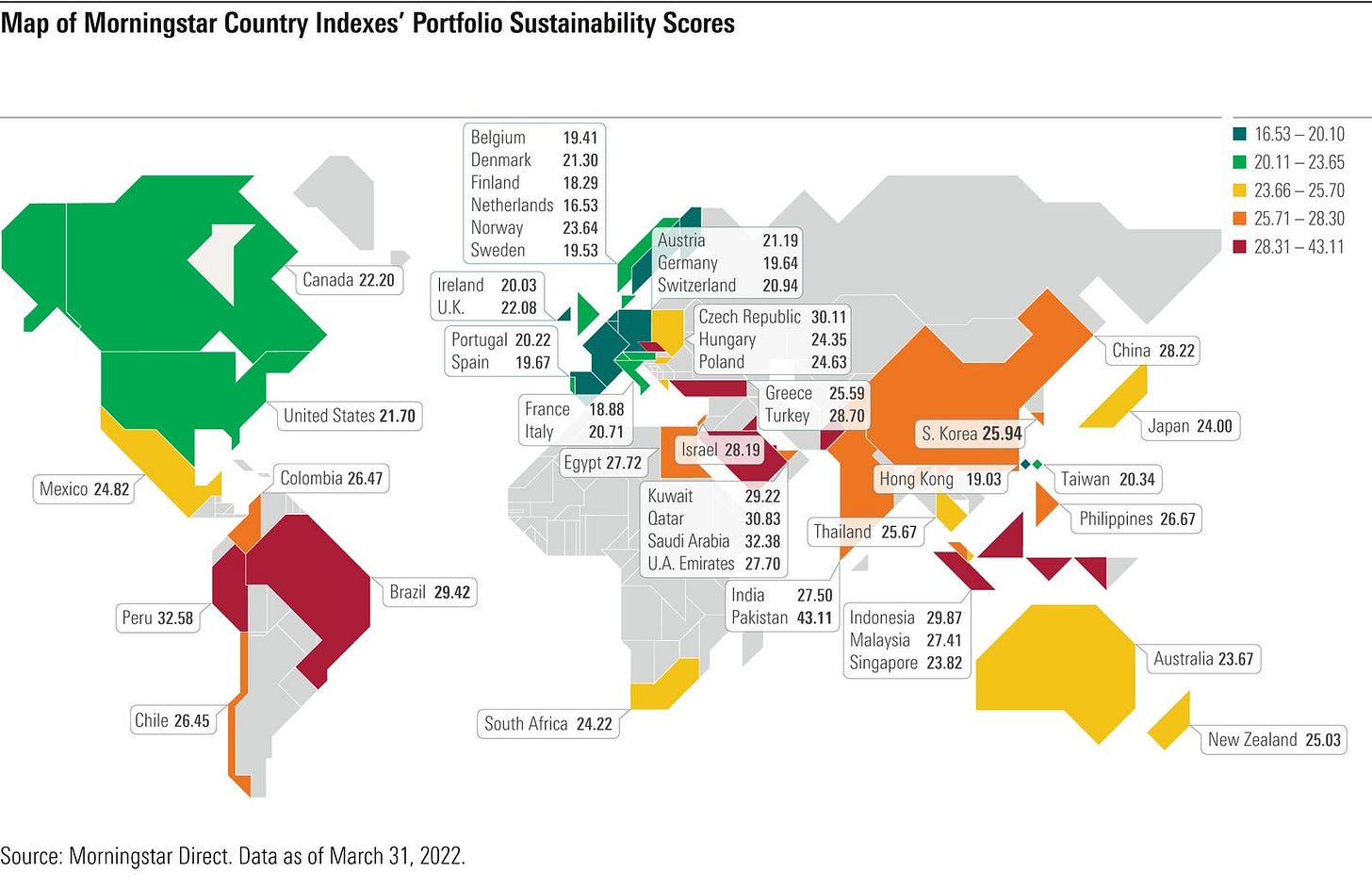

Environmental, social, and governance (ESG) initiatives have evolved from a corporate responsibility to a core component of business strategy throughout industries. To date, developed markets have led the change in ESG adoption, but emerging markets are increasingly realizing its importance as a means of securing foreign investment and fostering long-term sustainable growth. But ESG implementation in emerging markets presents unique challenges, specifically in balancing sustainability goals with immediate economic development.

Historically, ESG goals have not been the main focus in the growth trajectories of emerging markets. As we explore how ESG influences business strategies in these regions it is important to consider why it is being adopted, the complications faced, and whether it has or can be translated into measurable success.

Economic and Social Impact

The integration of ESG principles in emerging markets has had both economic and social benefits for companies that actively incorporate ESG strategies and often report improved financial performance, stronger investor confidence, and an overall better reputation. Studies show that firms with a stronger ESG policies tend to exhibit better risk management and long-term resilience which in turn makes them attractive to investors seeking stable returns, something important in emerging markets.

A major driver of ESG adoption in emerging markets has been pressure from large institutional investors, particularly those managing ESG-focused funds. Organizations like BlackRock and Norway’s Government Pension Fund Global, the world’s largest sovereign wealth fund, have encouraged stronger ESG alignment within their portfolios. Both are signatories of the United Nations Principles for Responsible Investment (UNPRI) and have required companies to meet ESG criteria before receiving capital.

However, this pressure is no longer as consistent as it once was. In 2024, ESG investing experienced a noticeable retreat due to concerns over underperformance and growing regulatory uncertainty. While some funds have stepped back, others remain committed to ESG objectives, especially in long-term growth markets like India, Brazil, and South Africa. In response, many companies in these regions are adapting their strategies to align with shifting investor expectations.

Despite this evolving landscape, there is strong evidence that ESG practices can drive financial value. A recent Cornell University study found that Chinese firms with higher ESG scores demonstrated greater financial stability and stronger stock price performance.

Beyond financial outcomes, ESG efforts have also contributed to meaningful social progress. Companies with strong governance structures often face lower corruption risks and show better compliance with trade regulations. Social initiatives, including fair labor policies, diversity programs, and community engagement, have been linked to improved employee retention and higher workplace productivity.

Yet, disparities in ESG prioritization remain as many emerging market firms focus more on social and governance issues than on environmental sustainability due to immediate economic demands and limited regulatory enforcement.

Case Studies and Corporate Commitments

Several companies in emerging markets have embraced ESG principles successfully. Nubank, a Brazilian fintech, embedded financial inclusion into its ESG strategy by offering banking access to underserved populations—expanding both social impact and profitability.

Tata Group in India has also embedded ESG into its business model, investing in renewable energy and committing to carbon reductions. These efforts have enhanced its corporate reputation while maintaining strong financial performance. Similarly, South Africa’s Naspers has used ESG to promote digital inclusion and innovation — reinforcing that sustainability and business growth can go hand in hand.

Environmental commitments are also growing across the private sector. Alibaba and Tencent pledged to reach net-zero emissions by 2030; Natura (Brazil) has been carbon neutral since 2007; and Infosys (India) since 2020. Sasol, South Africa’s state-owned energy and chemical giant, committed to reducing carbon emissions by 30% by 2030 and reaching net-zero by 2050.

Challenges and Considerations

Despite these advancements, ESG adoption in emerging markets faces significant hurdles. One of the most pressing challenges is the perceived trade-off between short-term economic growth and long-term sustainability, particularly in resource-intensive industries like mining and agriculture. Many emerging economies lack the financial infrastructure to make immediate sustainable transitions without jeopardizing profitability.

Another barrier is the lack of standardized ESG regulations. Without consistent disclosure frameworks, it is difficult for investors to assess and compare ESG performance across firms and sectors. This lack of transparency fuels skepticism and hinders capital allocation.

Additionally, some critics argue that Western-imposed ESG standards may unintentionally burden companies in developing nations with unrealistic expectations. These compliance requirements often overlook local economic contexts, exacerbating inequality and limiting growth. For instance, the European Union’s Taxonomy Regulation, which defines what qualifies as a “sustainable” economic activity, has created barriers for emerging market exporters whose practices don’t fully align with EU definitions, even if they are making progress relative to local norms. This kind of misalignment can limit access to green financing and penalize transitional efforts. In worst-case scenarios, it may even trigger capital flight from sustainable initiatives or push companies toward less ethical investors willing to overlook ESG concerns.

Greenwashing remains another concern. Some companies adopt the appearance of sustainability for branding purposes without implementing meaningful reform. This undermines the integrity of ESG and erodes investor trust.

Financial Realities and Mixed Signals

Recent financial developments have revealed tensions between ESG principles and profitability. According to Bloomberg data cited by the Insurance Journal (2024), ESG-focused investment funds in emerging markets experienced outflows for a third consecutive year due to tighter global monetary policy.

Paradoxically, some of the highest-yielding bonds in 2024 came from companies with poor ESG reputations, including Vedanta Resources (India) and Braskem SA (Brazil), delivering returns of 41% and 34%, respectively. In contrast, the average return for USD-denominated emerging-market corporate bonds was just 7.7%. This raises concerns about the financial viability of ESG-focused investing in these regions.

Data Gaps and Investment Risks

Another critical issue is the shortage of standardized, reliable ESG data. Investment professionals frequently express dissatisfaction with the availability and quality of ESG disclosures in emerging markets. Companies often lack the tools or training needed to produce reports that meet global investor expectations, particularly around biodiversity impact, supply chain ethics, and human rights compliance.

Without localized ESG frameworks that account for regional challenges, global benchmarks may penalize emerging market firms unfairly—restricting capital flows and discouraging sustainability initiatives. While traditional financing increased by 55% in emerging markets in 2024, green bond issuance dropped by 5%—signaling a lack of confidence in ESG-linked instruments.

Conclusion

The rise of ESG in emerging markets is redefining business strategies. What once was a soft PR consideration is now a strategic imperative tied to investment, innovation, and long-term resilience. However, the journey toward full ESG integration is uneven. Success will require localizing ESG frameworks, closing data gaps, and building policy support that doesn't penalize emerging economies for lacking the same institutional capacity as the Global North. Companies that embrace ESG holistically will not only build a better future for their communities but will also secure a sustainable competitive advantage in a rapidly evolving global economy.